Buying and maintaining equipment is costly, and as soon as you invest in a piece of machinery, it is only a matter of time before a new version comes out, making yours inferior or obsolete. Due to the high costs of operating and owning equipment, many small business owners opt to lease rather than own. Here is a closer look at what equipment leasing is and how it works, and when it might be the right choice for your business.

What is equipment lease financing, and how does it work?

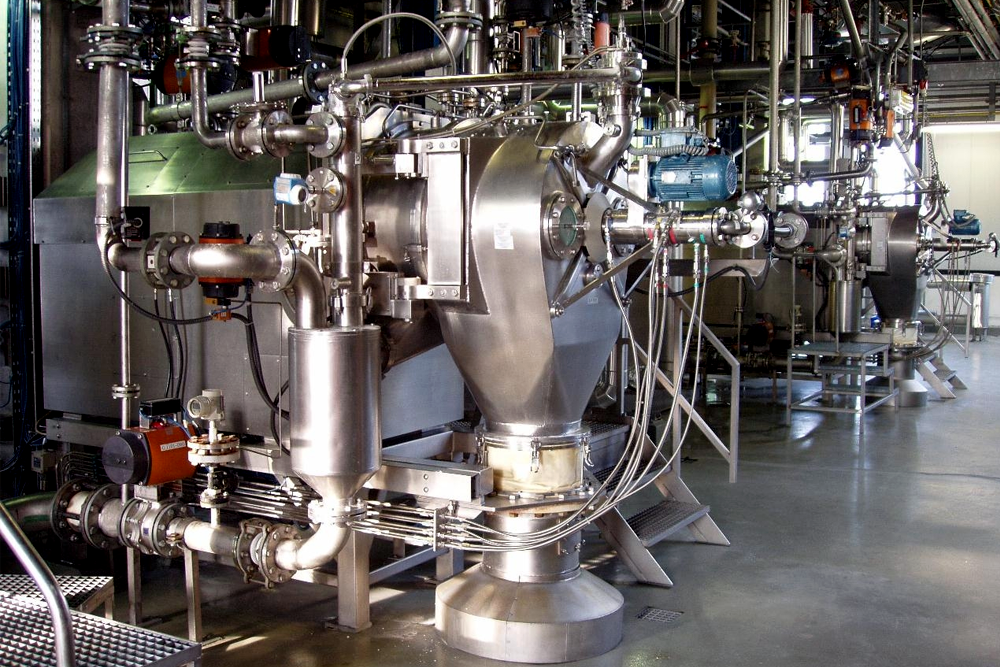

With equipment leasing, the lessor, the equipment owner, allows the lessee to utilize the equipment for a particular period in exchange for periodic payments. The subject of the lease can be factory machines, vehicles, or any other equipment. After the lessee and lessor agree to the terms of leasing, the lessee obtains the right to use the equipment and, in exchange, makes periodic payments during the period of the lease. Nonetheless, the lessor retains ownership of the equipment and has the right to cancel the equipment lease agreement if the lessee contravenes the terms of the agreement or engages in an illegal activity using the equipment. At the end of the lease, the lessee can choose to purchase the equipment, renew the lease, or return the equipment.

Following the Equipment Leasing Association of America, more than 80-percent of American companies lease some equipment instead of purchasing it. There are thousands of leasing companies that lease equipment to businesses in exchange for periodic payments. Most businesses lack the budget to acquire large machines whose cost might run into millions or billions of dollars and, thus, opt to lease the equipment for a particular period. Some of the high-demand lease equipment includes high-technology equipment like computers, diagnostic tools, and telecommunication gadgets.

Types of equipment lease financing

Generally, there are two main types of equipment leases: capital leases and operating leases. Here’s how they differ:

Capital leases

A capital lease is usually non-cancellable and long-term and is utilized to lease equipment that the business wants to use in the long term or buy at the end of the lease duration. In this lease, the lessee is accountable for maintaining the asset and paying any taxes and insurance associated with the equipment. The equipment’s liabilities and assets are recorded in the lessee’s balance sheet during the lease period. Companies prefer this type of lease when renting expensive capital equipment that they might not have the finance to purchase immediately.

Operating leases

An operating lease is usually cancellable and short-term before the expiry of the lease period. It is famous for companies that want to replace the equipment at the end of the lease or use the equipment for a short period. The lessor retains possession of the equipment and is responsible for the risk of obsolescence. You can cancel the equipment lease agreement, with prior notice, at any time before the expiry of the lease period; however, usually, there is a penalty.

Apart from the two kinds of leases mentioned above, there are other kinds of equipment leases that combine the features of operating and capital leases to meet both parties’ needs. For instance, the lessor might opt for a hybrid equipment lease for financial and tax advantages. Leveraged leases enable the lessee to finance the lease cost by issuing debt and equity against the equipment lease payments.

How to finance equipment lease?

For companies that lack adequate cash reserves to finance equipment lease, there are several avenues they can pursue to get financing assistance or lower rental costs. These avenues include:

Leasing companies

In recent years, several leasing companies in the United States have risen steadily to cater to leasing equipment’s growing demand. Leasing companies vary in product quality, and services, and leasing terms. A business owner should first approach various leasing companies to assess each company’s terms and equipment lease agreements. Also, doing a background check on each company’s reputation and talking with former and current customers can help weed out rogue firms.

Banks and bank-affiliated companies

Some banks provide credit to small and medium companies to help them lease expensive equipment. Banks charge lower fees and might offer better customer service than companies that are not predominantly in the financing business and are thus preferred by borrowers. Some banks also service periodic transactions based on your agreement with them.

Equipment distributors and dealers

Equipment dealers and distributors usually own subsidiary companies that provide equipment leasing services. Visit the equipment dealers and inquire if they provide financing arrangements for their equipment.

Benefits of equipment lease financing

Equipment lease financing advantages include:

- Save Money: Instead of funding with a large down payment, equipment leasing financing requires a minimal deposit and low monthly payments designed around your budget and needs.

- Protect Credit: A lease enables you to keep your business credit line open, which allows your business to receive financing for staffing, expansion, and other needs. This also prevents the need to spend resources and time finding someone to extend credit for buying equipment.

- Stay Competitive: Leasing enables you to quickly access the latest technology and equipment at an affordable price. This will also help your company avoid outdated equipment and easily upgrade to newer ones, unlike with bought equipment.

- Avoid Obsolescence: Because machinery and technology evolve faster, older equipment quickly becomes obsolete and out-of-date. A lease can be designed to match the life of the equipment.

- Avoid extra costs: In addition to the cost of the equipment, equipment leasing can also include additional expenses such as installation, maintenance, and delivery.

- Have choices: With short-term equipment leasing financing, you can assess if equipment truly works for you and your company.

- Section 179 Tax Benefits: Typically, lease payments can qualify as an expense. They are fully deductible on the equipment your company uses. When eligible as an expense, the equipment is also not listed as a liability or asset on your balance statement, avoiding debt and simplifying accounting.

- Fixed Payments: Lease payments are not impacted by market conditions and are fixed for the lease term, protecting against inflation and higher payments.

Cons of equipment lease financing

Equipment lease financing also has its downside; however: You might pay a higher price over the long term. Another shortcoming is that leasing commits you to retain a piece of equipment for a particular period, which can be problematic if your company is in flux.

Remember that every lease decision is unique, so it is essential to study the lease agreement carefully. Examine the terms to see if they are favorable and compare the leasing costs to the current interest rate. What is the equipment lease costing you? What are your savings? Compare those figures to the cost of buying the same piece of equipment, and you will quickly see which is the more profitable route.

When equipment lease financing may be the right choice for your business?

Equipment lease financing can be a smart strategy to get the equipment you need; however, with other options such as heavy equipment loans and commercial vehicle financing, how do you know when equipment lease financing is the correct call?

Lease financing can be the right choice in a wide range of scenarios

- You need equipment to complete work or stay competitive, but do not have the cash flow or capital to commit to a loan.

- It is not feasible for you to meet collateral requirements or a down payment to buy an expensive piece of equipment.

- Equipment needs or technology change faster in your industry, or change based on your projects.

- Your company is rapidly growing, and you do not want equipment purchases to tie up all your operating capital.

- You need to go through a straightforward application process.

- You want extra support. When you lease equipment, the leasing company might pay for repairs; however, it depends on your contract.

- You are looking for flexible contract terms such as trading in, purchasing, or returning the equipment after your lease ends.

- You are hoping to capture tax benefits. With the IRS Section 179 tax deduction, the cost of leasing equipment up to $1 million might be fully deductible in the same tax year.

Remember, the main downside to equipment finance leasing is the total cost. It might be more expensive to lease a piece of a commercial vehicle or heavy equipment than it is to fund the purchase. However, when looking at a more nuanced picture with different considerations — from tax implications to current cash flow to evolving equipment needs — equipment lease financing might be the right choice for your business. If you have started the process of seeking equipment financing, wondering, “What is equipment lease financing?” and now you are convinced it could help your business grow, take the first step. Upgrading your equipment, opening up new lines of business, and solidifying your brand can help lay the foundation for future success.