Commercial equipment financing options come in many sizes and shapes, so it is essential to understand your financing agreement’s rates and terms before you sign. One of the most critical aspects affects the interest you will pay on your equipment loan or lease. While you will mostly see fixed interest rates for equipment loans, it is also possible to get a variable-rate equipment financing. But what does this mean for your loan? And which option is most appropriate for your business? This article will discuss the equipment financing terms and rates, the difference between fixed and variable interest rates, and explain the best option for equipment financing.

What Is Equipment Financing?

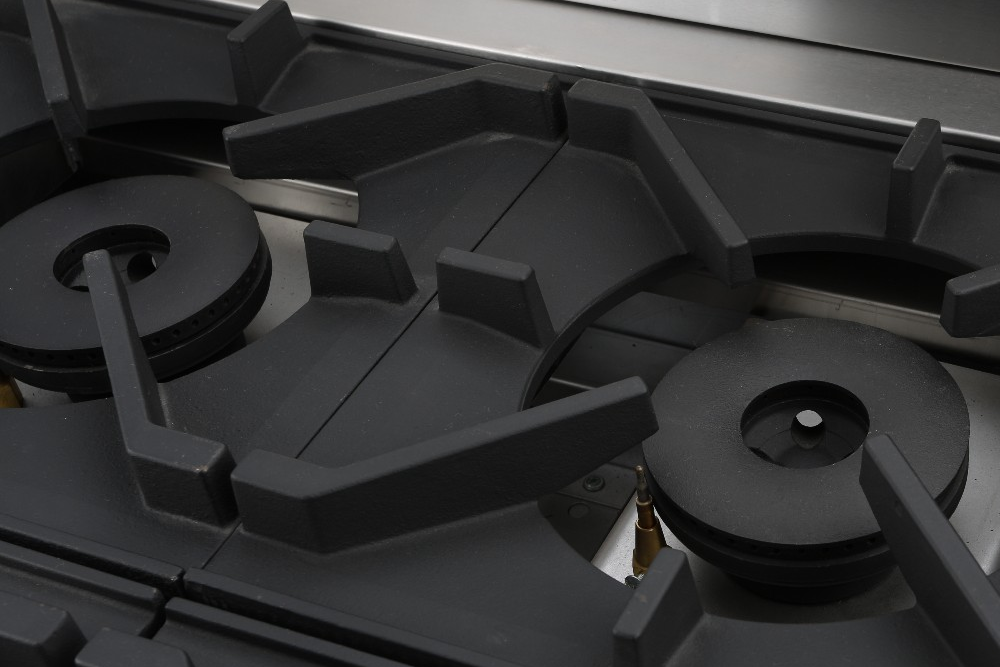

Equipment financing is a kind of business loan that offers capital specifically for the aim of purchasing used or new equipment—whether technology, machinery, or vehicles, machinery. You can access equipment financing equal to up to 100-percent of the value of the equipment you are looking to buy. Equipment loans are then paid back over time, with interest. Like invoice financing, business equipment financing is a kind of asset-based financing, in which the equipment itself acts as collateral for the loan. For this reason, equipment financing is usually easier to qualify for than other types of small business loans. Along these lines, equipment loans can be great options for startups or businesses with poor or average credit scores.

What are the equipment financing rates and terms?

As with all business financing, terms and rates will vary based on current market conditions and applicants’ qualifications.

Equipment financing rates

There is always a cost of accessing funds to improve your business. With equipment financing, lenders express these costs via APR and interest rates. Here is how they differ. Interest rates is the most common term utilized to describe the cost of borrowing funds. Typically, this is the amount of money charged by a lender against the principal loan, and it is expressed as a percentage and does not include associated fees. This is the rate you would input into the business equipment loan calculator to estimate your payments.

When it comes to equipment, financing rates generally range from 4-percent to 40-percent. Of course, the interest rate you get will vary; however, overall, these rates are typically affordable. If a borrower falls on the lower end of the interest rate range, you will receive rates that are akin to SBA or bank loans. Besides, you might be able to save additional cash on the cost of your equipment and your taxes through taking the Section 179 business tax deduction.

Variable Vs. Fixed Interest Rates for Equipment Financing

Most equipment financing options come with fixed interest rates and for a good reason. A fixed interest rate indicates you will pay the same percentage of interest every period. Generally, the interest rate is locked in, thus no matter what happens to the lender’s general interest rates, or the market, you will pay that fixed rate for the whole duration of your financing term. The main benefit of a fixed interest rate is that you can predict exactly how much you will be paying each period and the loan cost. This information enables you to fine-tune your funds and budgeting to fit your business purpose, and it also eliminates any surprises from the financing procedure.

With equipment financing, most borrowers know exactly how much money they require. They are looking to attain a specific kind type of equipment and utilize it for a specific period. Fixed interest rates work perfectly with these businesses’ need for monetary predictability. When mixed with fixed interest rates, equipment loans, and equipment leases, businesses of all types can attain accurate budgeting and financial planning.

Generally, it is best to match the loan term’s length to the useful life of the buying equipment. When you combine a fixed interest rate with an appropriate financing term, you set your business up for accurate budgeting, depending on established best practices. Equipment financing options with variable interest rates still have their uses. If your equipment loan comes with a variable interest rate, then the interest rate will move down or up ground changes in the market. The variable interest rate is often linked to an index rate, which is a benchmark rate based on market factors.

The benefit of variable interest rates is that if the market rates reduce, so will your loan’s interest rate. The reverse is also true; if market rates go increase, so will your interest payments. The majority of businesses use these lines of credit to fund inventory and receivables on a short-term basis, and your business may want to consider doing the same where it makes sense.

How can I get a great rate on equipment financing?

To get great equipment financing rates, compare various rates provided by different lenders. Counter to common belief; you do not have to settle for a high-interest rate if you have good to excellent credit score. Moreover, you stand a higher chance of getting a great interest rate if you have good credit. A borrower can obtain an interest rate as low as 7.5%, but the rate can be based on various criteria:

- Credit Score

- Business Income

- Debt-to-Income Ratio

However, a good interest rate must coincide with a suitable term that’s within your budget.

How can I get a good term on an equipment loan?

A good term is based on your business needs and budget. If you want to finance with a shorter term, you will pay a higher monthly payment but less interest overall. If you need a longer lifespan loan, you will pay more interest over time; however, you will have a lower monthly payment. Try to talk to a loan representative to determine which option is best for your business.

You can obtain a term that lasts up to eight years under an equipment loan program. As discussed earlier, get an equipment loan with a fixed term and interest rate, indicating that the rates and terms do not change all through the loan term. A fixed loan assists you to manage your finances without abrupt surprises. Remember, variable rates and terms can disrupt your cash flow and may jeopardize your ability to repay the loan.

Equipment financing terms

Equipment financing usually involves less time to apply. Usually, you will get a faster answer from the bank as opposed to a typical small business loan – often within a few days of submitting a loan application.

Alternative lenders also provide equipment loans. These financiers will also get you an answer to your loan request within a few days, providing a good option if you require the equipment fast. However, you might pay a higher interest rate when compared to a credit union or traditional bank loan, but are likely to have a shorter loan term-typically 12–72 months and will vary by loan option and lender.

Note that, at its core, an equipment loan term comprises the payment frequency, how long you have to pay back the debt, and the borrower’s and lender’s expectations. When determining your loan term, lenders consider what the business requires and what you qualify for within their lending structure. Not unless you pre-pay, the number of monthly payments and terms is fixed. Typically, equipment financing payments are made monthly but can vary based on the lender you choose and your business’s unique qualifications.

The term will also explain each party’s responsibilities and rights and what would occur should something go wrong during the relationship. While terms from different lending institutions vary, most lenders will ask for a down payment, possibly 20-percent for the loan. An SBA 504 loan will require a 10-percent down payment. As with most business financing, the interest on an equipment loan is tax-deductible.

How to apply for equipment financing?

Suppose you are a small business owner, and now that you understand equipment financing terms and loans, you are considering business equipment financing. First, you need to learn how to select the right financing for your business equipment and how to apply it from various lenders. The application process for applying for equipment business loans is very fast and easy when the equipment expenses are under $200,000. When the equipment cost is under $200,000, the complete application and closing process can be completed within one day.

“Small-ticket” equipment loan decisions are mainly driven by the kind of equipment and the business owners’ credit quality. With good personal credit, if your company has been in business for a long duration, and if you are funding high residual equipment, you can expect the application procedure to take just about two days.

Nonetheless, if the equipment purchase is over $200,000, more financial information could be needed before closing on the deal. This procedure can take anywhere from seven to 14 days because of the more thorough underwriting process or, the larger funding amount approval. Again, all of the particular details will vary from one lending institution to another, so if your small business is contemplating business equipment loans, ensure you browse the potential options available for you.