If you need to secure funding fast for your business, you will likely need a short-term business loan. However, with so many different loan options on the market- it can be hard to know which type of short-term loans are right for your company. That is the reason we have developed this post to cover the ins and outs of some of the most common types of short-term loans. Here we have outlined what you need to know about these types of loans. Hopefully, this will make the process just a little bit simpler.

What all types of short-term business loans have in common?

Even though short-term loans generally fund faster, their name actually refers to how faster they are paid off, instead of their funding speed. Typically, short-term loans will reach maturity-or will be paid off in full, including interest- in about six to eighteen months. When you get into business loans with repayment terms over that, they are generally considered medium- or even long-term business loans. In fact, your non-short-term business loan options can come with repayment terms anywhere from over a year to twenty-five years. Even more, some kinds of short-term loans will not even come with a designated repayment term- you will have to pay a sum daily until your loan is paid off (often in about a year or so). Apart from their similarity of having a short repayment term, short-term loans can come in all sizes and shapes.

Types of short-term loans you should know

The 4 best short term business finance options

To get a deeper look at your short-term loan options, we have broken them down into five main short-term loans. Let us dive into what these short-term financing options can provide your business:

Merchant cash advances

A merchant cash advance is when a lending institution purchases your business’s future credit card sales, which eventually fulfills the same purpose as a short term loan. This kind of short term business loan is one of the most widespread, accessible types of business financing. Nonetheless, it is often the most costly type of short term loan, as well.

Merchant cash advances are repaid via your credit card point of purchase technology- whether it is a tablet plugin or a simple credit card machine. Your creditor will intercept a daily percentage of your business’s credit card revenues before reaching your business’s accounts. This will occ every day your business has credit card transactions till your merchant cash advance is paid off in full. That is the general idea of how merchant cash advances work; however, let us take a look at the logistics of what this kind of short-term loan can provide your business:

Merchant cash advances terms

Typically merchant cash advances fund small businesses with loan amounts varying from $2,500- $250,000 with factor rates from 1.14 – 1.18. This funding source will not come with a predetermined repayment term; however, it will still be regarded as short-term since its daily payments almost always make sure that your merchant cash advance will be paid off comparatively faster.

The requirements

To be fit to apply for a merchant cash advance, you will need:

- At least $50,000 in annual revenue

- 500+ personal credit score

- At least one year in business

Lines of credit

This short-term loan option works much like a business credit card- you will receive a credit limit that you can tap into as required and then repay whatever you spend gradually. Nonetheless, this short term financing option always deals with cash advances. Besides, you will often be able to access lower APRs with a business line of credit than a business credit card. Typically, business lines of credit do not come with the rewards, like travel miles or cash back, that are offered by a business credit card. Nonetheless, a business line of credit is often worth sacrificing the glamorous perks that a business credit card promises. Besides, these two products are not mutually exclusive. Thus spending on both of them can get your business the best of both markets.

Terms of business lines of credit

Business lines of credit can range from a $10,000 credit limit to a credit limit of over $1 million. Even though medium-term credit lines with repayment terms more than a year do exist, your repayment term for a business line of credit will almost always range from six months to twelve months. Besides, your rates for business lines of credit can vary anywhere from 7 to 25-percent.

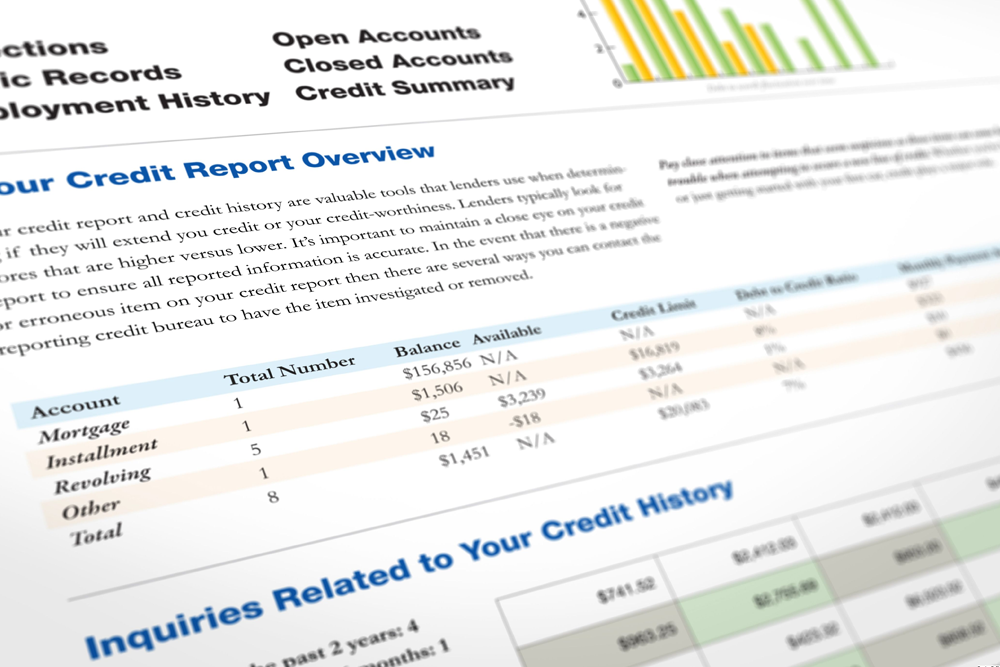

Requirements for short-term business loans

If you fulfill these two minimum requirements, your chances of qualifying for a credit business line are much higher:

- At least $50,000 in yearly revenue

- At least six months in business

Invoice financing

This kind of short term loan acts to provide a solution to a very particular financial conundrum- a cash flow stifled by outstanding invoices. A lender will advance you a percentage- sometimes as high as ninety-percent- of your outstanding invoice’s worth through invoice factoring. Ground on how many weeks your invoice is outstanding when you get financing, your advance will accrue interest at a comparatively low rate.

After your client fulfills your invoice, your lender will intercept the remaining percentage of your invoice, deduct and claim the interest that you accumulated, and then return the rest of the invoice’s worth to your business. Since your outstanding invoice will serve as a form of collateral, this type of short-term loan is one of the most inexpensive and the simplest to get of all your short term options. Let’s look at the terms and qualifications:

Terms

Through invoice financing, you will be able to get an advance worth 50 to 90-percent of your total invoice amount. Based on how long your invoice will be outstanding, you will possibly pay interest rates around three plus one-percent or so for any week that your invoice is outstanding. When it comes to the term length, that will also depend on the nature of your invoice. Eventually, your term length will be the same amount of time that your invoice is outstanding, so invoice funding is by no means strictly short-term financing. Since your interest rate will go up with every week that your invoice is outstanding, invoice funding does work best for small businesses if it is over the short term. Otherwise, a longer-term invoice factoring options could become one of the more costly financing options.

Invoice factoring requirements

Since invoice funding is a form of a self-secured loan, its minimum qualifications will comparatively lax, even for a short-term loan. As for requirements that you and your business have to come to the table with, you will just need:

- At least $50,000 in revenue

- At least six months in business

Short-term loans

Just as the name suggests, the short-term loan is the most simple of your short-term loan options. This loan type works like a condensed version of a traditional term loan- your business will get a lump sum of cash that it will pay off, and interest, following a predetermined payment schedule over a predetermined term.

Nonetheless, you will have to pay off short-term loans much faster than a traditional term loan. As such, they are frequently less manageable in the context of payment amount and frequency, with high daily or weekly payments. Short-term loans are usually one of the most affordable options of all the kinds of short-term loans available Short-term loans are frequently one of the most affordable options of all the kinds of short-term loans available to entrepreneurs.

Terms of short-term loans

Generally, short-term loans can offer some of the largest loan amounts and the lowest APRs of all the kinds of short term loans available to small business owners. With business loan sizes that usually range from $2,500 -$250,000 and interest rates beginning at ten-percent, short-term loans can offer terms that might even compete with what a traditional term can offer. With that said, by definition, short-term loans will always come with shorter repayment terms. Usually, the short-term will carry a repayment term of three to eighteen months.

The requirements of short-term loans

Like other types of short-term loans, you will need to fulfill some minimum qualifications to be eligible for this financing option. Before you decide to apply for a short term loan, ensure you and your business have these requirements under your belt:

- At least $50,000 in annual revenue

- 550+ personal credit score

- At least one year in business

As long as you do have these minimum requirements covered, then you will still require to compile a stack of the following documents to move forward in applying for a short-term loan. Even though a small business loan might appear like it will always have a lot of paperwork, most types of short-term loans can get your business financed in under a week, if not a day. You have already done the hardest part-getting all of the necessary information on your options- through reading this post. The next step is simple, just apply, and you will be on your way to getting funds for your business.