Equipment Financing Process: A Guide For Small Businesses

Starting a business is not only a decision but also like a journey bound to give a rich experience in the process. If things are done rightly, this decision will also make you rich financially. There are so many start-ups coming up with ideas for the market every day. For small businesses to sustain and grow, they need to have a financial backup, either by obtaining financing from investors or loans from banks.

The financing requirement and the time of when to get financing are different for different industries. For technology or E-commerce startups, the financing is required after coming up with the early version of the product. Nonetheless, sectors such as manufacturing, construction, packaging, and others depend on proper equipment and machinery, which helps them carry out their operations. The initial purchase and the setup cost of the equipment can be huge when considered with a machinery finance point of view. It is smart for small business owners to get equipment financing from lenders since this will give them the freedom to use their own reserve funds more innovatively.

These companies are continuously dealing with the purchased equipment like wear and tear and frequent up-gradations. As technology advances, new machinery with extra appealing features are always being launched is always a preferred choice over the older types. A standard equipment financing loan can come in handy when purchasing equipment. There are several equipment loans available in the market which are specially customized for such needs.

To obtain an equipment financing loan requires some analysis of which lender to choose. Determining the right lender, getting all the documents in place, and ultimately channelizing the loan amount to optimum use needs to be worked out, and finally getting the funds. In this post, we will discuss the process of equipment financing.

In this post you will find:

- What is equipment financing?

- Equipment loans or leases?

- Reasons why you should get a business equipment loan

- How to get business equipment loans

- The process of getting an equipment loan

What is equipment financing?

Equipment loans are loans to purchase a piece of equipment for business purposes. Businesses will usually have the need to buy, repair, replace, or upgrade various equipment types to manufacture, process, or produce their product. Equipment can include things such as restaurant ovens, tables, cookware, chairs, tables, linens, and catering supplies; medical and dental medical machinery; phone systems; copiers, printers, computer monitors; furniture, industrial equipment, tools, vehicles (for commercial use), specialized machinery, and more. All of this equipment is vital for your business to run at maximum productivity and maximum efficiency. However, what do you do when your equipment is worn, old, and needs to be replaced? Often you have the choice to either purchase new equipment outright or lease.

Equipment Leasing vs Equipment Loans?

What is the difference between equipment loans and leases? Purchasing vs Leasing. When considering business equipment financing, know that you can also look into leasing the equipment. Here are some things to consider about equipment leasing versus getting an equipment loan.

Equipment Leasing

Leasing generally does not require a down payment. This is mainly beneficial for those companies with little to no available capital. If a down payment is needed, it is generally comparatively small compared to what a traditional loan down payment would look like. With lease agreements, you can fund around 100-percent of the cost of the asset or items plus around 20 – 25 percent of the so-called “soft costs.” Soft costs incorporate any delivery or tax charges.

Leasing offers your small or online business a greater amount of flexibility. The lessee can return the equipment at the end of the lease term, or you have the option to buy it for a small amount after the principal of the loan has been fully paid. Some of the benefits of equipment leasing include:

- Depreciation and tax benefits: equipment leasing is tax deductible as business expense on your tax returns and can save you significant tax deductions.

- Lower monthly payments

- Equipment leases help you to upgrade outdated equipment

- More attractive balance sheet

- Control and conserve cash

- Flexible lease payments

- You can return the leased equipment at the end of the term thus there is no risk of obsolescence.

Types of equipment lease options

How to lease equipment

There are two types of leases: operating lease also known as fair market value purchase option and capital lease.

| Capital leases (finance lease) | Operating leases |

| This type of lease comes with the advantage of fixed monthly payments. The lessor is the owner of the equipment but the lessee has the option to buy it for a nominal price at the end of the lease term. | The most notable functionality of this lease type is that its structure does not include a full payout of the cost of the equipment. |

Using equipment loans for equipment purchases

Each equipment financing company will have different terms, but in general, with a loan, you can finance around 80-percent of the item’s total purchase price. When choosing to purchase your equipment and finance through a loan, you own the asset from day one. A down payment of around 20-percent is generally needed for most small business equipment loans. The collateral for the loan is the equipment or items you buy with the equipment loan.

Reasons why you should get a business equipment loan

- To replace old equipment

- Add to your existing equipment inventory

- To update older or out of date equipment

- Buy an expensive equipment without using your working capital

Equipment leasing tax write-offs (tax deductions benefits)

You can utilize two broad methods to obtain capital assets such as computer equipment, vehicle, real estate, or machinery for your business. You can either purchase outright or pay with cash on hand or opt for financing, or you can lease them. Purchasing and leasing represent very different methods to add assets to your business, and they are also treated differently from a tax perspective. When you finance an asset, the irs allows you to claim two different streams of deductions. Typically every year that you pay interest, you can deduct all of the interest expenses. Besides, you can also gradually depreciate the asset, claiming a yearly expense to write off its value down and reduce your taxes.

How to get business equipment loans

Excellent credit score is needed for most equipment loans. After all, it is an investment in your company and your business’ revenues and growth. You might want to consider applying for financing at the bank with whom you currently do most of your business. Or you might want to consider independent lessors such as Top Financial Resources, an online lender that assists online and small business owners in need of fast access to capital to grow their business. Business loans provided through Top Financial Resources – sometimes referred to as Top Financial Resources lines of credit – might be an option. A business loan offers businesses upfront cash in exchange for a percentage or a section of future credit card sales.

If you have had strong sales, but you struggle with little or bad credit, a business loan might be a particularly good option for your online or small business. Getting the capital you require when you need it can mean the difference between your company’s success or failure.

Note: You generally will not be eligible for a line of credit for an equipment loan if you have a prior bankruptcy on file, and your business has been in existence for less than six months or if you do not already have the ability to process credit card payments for your clients. Ensure all of these things are in place before applying to a traditional lender or a nontraditional lender such as Top Financial Resources.

Like banks, traditional lenders are usually reluctant to extend traditional equipment loans to small or online businesses with poor or bad credit. Such businesses will be deemed “too risky” and will have great difficulty in obtaining a traditional bank loan for their business needs. This can be a challenge for many online and small business owners who need the capital to buy, replace, or repair outdated or broken equipment. This is where a business loan can come in handy. A business loan gets you the money you need at a fast turnaround time so you can continue to run the day to day operations of your business. You can also consider other equipment financing options such as business credit cards, business lines of credit, invoice factoring and term loans, merchant cash advance.

The process of getting an equipment loan

As your company grows, you will need to replenish your inventory, provide annual, monthly, and daily maintenance on key equipment, and ensure timely delivery of your services or product. Equipment financing loans are a vital resource to the small or online business owner.

Step 1: Ensure your credit is in good shape.

Defaulted on some loans? Had late credit card payments? A history of bad credit? All of these things can work against you when you apply for equipment financing. Most equipment financing companies will not extend any type of loan to a small business that is deemed too risky. One of the most significant – if not the most important – small business loan qualifications is making sure your credit is excellent. Preparation is key. Carry out your research ahead of time. Get to know your FICO score – a summary of your credit risk, which equipment finance providers use to assess things like whether to extend credit and, if so, check the interest rate. You can find out your credit risk and identify your FICO score using free online tools like the one at www.fico.com.

When meeting with potential lenders, go prepared to show not only your business credit history but also your personal credit history. Got a few late car payments? Credit card debt? Student loans in default? These types of things will delay if not halt the equipment financing approval process. Excellent credit is a basic aspect of small business loan requirements. Work aggressively to clean up your credit, fix any credit reporting errors (*Note: credit reporting errors do happen. Take time to read your credit reports thoroughly to ensure accuracy. Report any discrepancies immediately).

Step 2: Have a solid business plan.

Financing companies – traditional bank lenders and some nontraditional lenders – will check your business plan as a blueprint of your future success. Identify your business. Describe your service or product. Detail your present cash flow system and project an aggressive but realistic set of goals for your future business growth. Identify your target market, the economic and socio-demographics of your main market, and explain how your service or product will fulfill this market’s needs. Lastly, summarize your whole business plan in a few paragraphs at the beginning of your plan and then call it the “Executive Summary.” This will provide lenders a good synopsis of what your company is all about. Note that a good business plan does not take too long.

Bottom line: a business plan should be thorough and well thought out. There are numerous templates and samples of business plans online. Identify one that works for you and adapt it as part of your strategy to secure your equipment financing loans.

Step 3: Ensure you have an updated personal resume.

Even if you are not applying for a job, a personal resume is a great resource to have when applying for equipment financing. Lenders of all kinds – traditional bank-based and non-traditional lenders – look to a personal resume for character traits that will support the online or small business plan. They want to see the person behind the business. Because you will be responsible for the loan repayment, the financing company will want to ensure you are a good credit risk for any equipment loans issued.

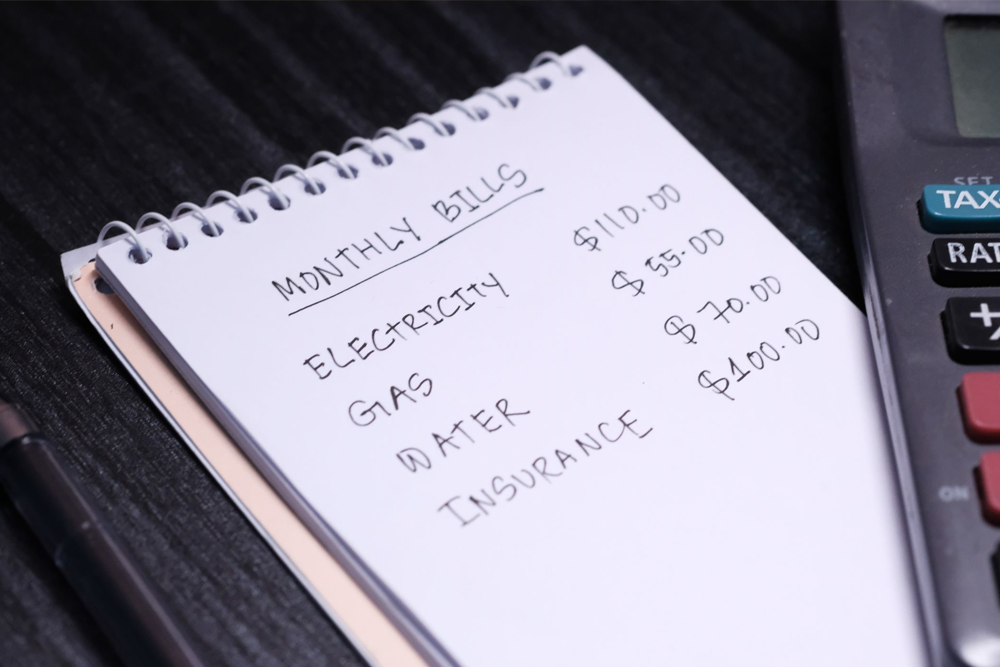

Step 4: Have working capital and cash flow statements ready.

Being able to show your money coming in and out in current terms is a vital factor that most lenders require before issuing any type of equipment financing loan. Get your finances in order. If need be, hire a certified public accountant to go through your financial records. You will have to ensure you have both your business and personal financial statements in order and bulletproof – indicating the level of integrity in your reporting is ethical and accurate. It is one of the best indicators of how your business is doing in the real world, and it is one of the main things equipment financing companies consider when reviewing small business loan requirements.

You can now make your application. How long it takes to learn whether you are approved for financing depends on the equipment leasing company. It may take months to get approval for a small business loan from a bank, mainly a large one. Smaller, regional banks tend to take significantly less period of time to process small business loan applications.

But the approval process is typically much faster if you apply for the loan online, with some lessors approving loan applications within hours of receiving them. Top Financial Resources approval is within 48 hours after we receive your full application, but it can take up to 72 hours, depending on how quickly you provide the required information, as well as the amount of funding being requested. When it comes to financing, usually you will get the funds within 24 hours after a contract is executed and received.