Operating a small business requires patience, dedication, time, and critical thinking skills. Nonetheless, few small business owners understand the differences between cash flow and working capital. Because both of these terms involve a given business’s financial responsibility, many business owners use them interchangeably. Sadly, stakeholders, lenders, and business partners might make negative decisions for a business if either of these terms is utilized incorrectly to prepare financial statements. There is an old saying that if you pay attention to the pennies, the dollars will take care of themselves. In this spirit, let us break down the concept of cash flow versus working capital and how you can handle them in your business.

Cash flow vs. working capital: What is the difference?

Understanding the difference between cash flow and working capital is essential for anyone who truly wants to understand his or her business.

What is cash flow?

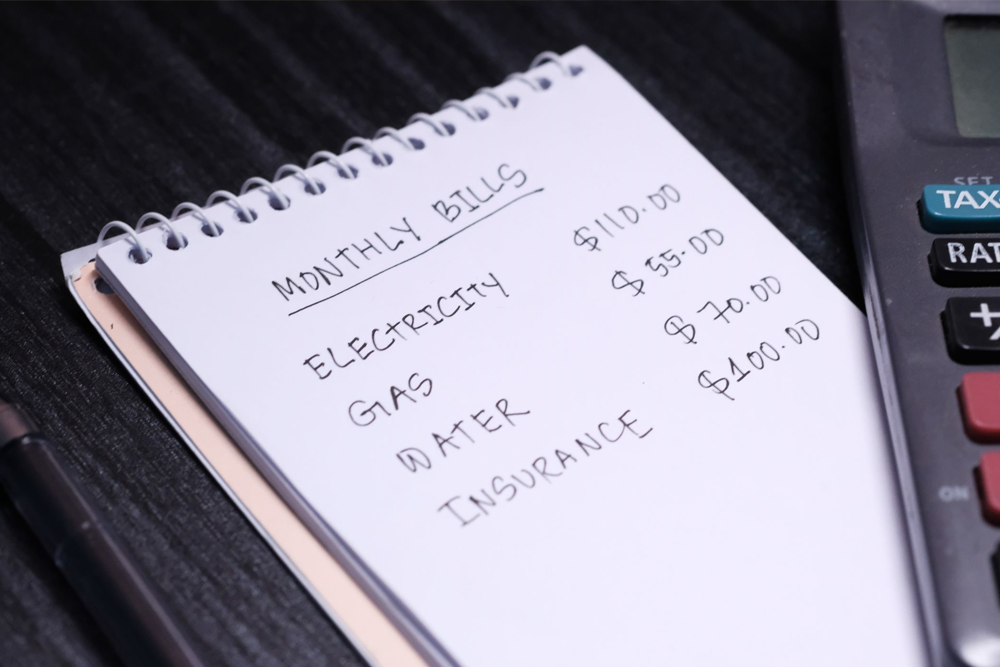

Consider a typical week or month in your business. How much money are you able to accumulate and utilize for expenses in this set duration? This is a cash flow summary, and it shows how money moves in and out of your business. You might want to generate a cash flow summary for a quarter or even a year in some cases. However, a cash flow summary does not consider how your current assets impact your business’s financial responsibility. Since your business’s net profits reflect your liabilities or expenditures against your income, the cash flow summary will never correctly reflect your net profits. Typically, the cash flow summary is a means of gauging and tracking how much money can be gathered from your business in any given time frame.

Working capital and your assets

The main consideration in understanding the difference between cash flow and working capital involves liabilities and assets. Contrarily to your expenses in a cash flow report, working capital takes into account how much your outstanding debt compares to your current assets. For instance, if you have a current loan of $10,000, you would commit to making payments on this loan as time goes on. Nonetheless, an unforeseen decrease in your client base can hinder you from making payment, and the lender can demand full repayment of the loan at the end of the month. The working capital enables you to see what debts can be solved by liquidating your existing assets.

Obviously, this is an extreme situation. Mostly, the working capital report is generated on a twelve-month scale, and it takes into account all debts due within the next year. Typically, the working capital report identifies what can be sold or liquidated to generate cash to pay down existing debts if your company experiences a gradual or sudden decline. This is a vital aspect of scalability. Contrarily to the cash flow report, working capital does not routinely include your planned monthly expenses that have not been paid for on loan or credit.

Calculating working capital

Working capital is the gauge of a business’s liquidity and is factored into valuations. In essence, acquirers purchase working capital in a perfect dollar-for-dollar exchange when they purchase a company. An entrepreneur can often take away excess cash, retained earnings, or common stock. However, only if those are not figured into the working capital. They will not have been in a perfect case, though not everything is clear if you only use the basic calculation. The classic formula for working capital is easy:

Current Assets – Current Liabilities=Working Capital

“Current” often means maturing within the next calendar year. However, this formula is too simplistic for purposes of a sale and open to loose interpretation. Do current assets incorporate common stocks and cash? Do liabilities include taxes? Whereas the entrepreneurial instinct to deduct liabilities and assets is close, it is incomplete. A more precise (however, still simplistic) formulae is to look adjusted working capital (AWC):

Accounts Receivable + Inventory – Accrued Operating Liabilities- Accounts Payable= Adjusted Working Capital

Both formulas utilize balance sheet values; however, they diverge in one important respect. The classic formula might include cash as an asset, where the AWC formula does not include cash at all. The nuances aren’t always critical when running a successful business, but can be extremely important in negotiating a sale.

Why is maintaining a cash flow summary and working capital important to scalability?

Growing your company can be challenging. You must determine how much product your clients will need, how many employees will be required to ensure your clients are satisfied and happy, and what business processes will change to adapt to the new demand. Sadly, even well-planned companies will sometimes experience a periodic decline in sales. This might be the result of economic instability, unidentifiable factors, or new competition.

When a decline happens, how will you pay your bills in the meantime? You might be able to generate sufficient cash flow to scrape by if business picks up. Nonetheless, if the business does not pick up, can you liquidate your existing assets to cover your debts and liabilities? Now, consider how your company’s growing expenses play into liability and asset generation. If you purchase new equipment, take out a loan to cover your expenses in the process of growth, lease a new office space, you will incur a new liability. No matter how successful growing your business turned out to be, you owe this debt. Proprietary information, physical items, such as desks, computers, and inventory, can be liquidated to generate cash flow. As we have explained previously, you can reduce the risk of developing a negative working capital by growing in stages.

What do working capital and cash flow have to do with resiliency?

Scalability is often used to denote business growth. In actuality, the term can be applied to either the contraction or growth of your existing business. On the other hand, resiliency refers to how fast your business can respond to an issue and return to its original state. In the case of a decline, your business can be more resilient if your working capital surpasses the debts you can expect to pay in the next year.

If you were to apply this concept to the cash flow summary, you would be incapable of determining how your company would stay afloat. The only details you would have would be how much money was accumulated and how much was spent. Ideally, in the case of a decline, your cash flow will rise, and your debts will be paid. Unfortunately, this type of thinking will cause problems and an even greater chance of failure.

Managing cash flow and working capital

The best way to manage cash flow and working capital is to have accurate financial records throughout your company’s life so you can make the right financial decisions. You have to get back to your accounting basics and optimize your accounts payable or accounts receivable tasks so that you are invoicing your clients correctly and in a timely manner to generate cash flow further. You also have to make smarter inventory management choices. You want your small company to have the right amount of inventory to satisfy sales orders without sinking too many funds into buying products that will not move off the shelves fast enough.

Another thing to consider is how you are investing in your business. Are you buying equipment and products that are essential to operations and business growth or just throwing money away on the newest innovations that won’t have a significant impact on processes? Also, consider whether it is the right time to acquire debt from bank loans for business expansion, or if you are acquiring too much long-term debt that can make it tough for your business to repay eventually.

Having correct financial records and bookkeeping will always enable you to keep track of your small business’s cash flow and working capital. Provided you are concerned about your company’s financial health, hiring outside accounting services can assist you in auditing your financial records, spot mistakes, and offer advice on how to get your company back on track when you want to improve your working capital and cash flow management.

Take away for investors. A business’s working capital is a core part of financing its daily operations. Nonetheless, it is important to analyze both the company’s cash flow and working capital to determine if the financial activity is a long-term event or short-term event. A boost in working capital and cash flow might not be good if the business takes on long-term debt that does not generate enough cash flow to pay it off. Conversely, a big decrease in working capital and cash flow might not be so bad if the business uses the proceeds to invest in long-term fixed assets that will generate earnings in the years to come.